Click the image to downlaod

a PDF copy of the report

(5 meg.) |

In the Executive Summary of the report, it explains that in 2010 the WSIB instituted many forms of cost cutting. The WSIB justification was to develop a fund to cover the costs of the WSIB’s unfunded liability.

An unfunded liability is a liability that is owed by a person, business and/or government agency and the liability is a liability that is not funded.

So, for example when workers are working their employers pay premiums into the WSIB in the vent the workers get hurt form a work-related accident. If the worker suffers a serious work accident they are no longer working. The WSIB pay the worker replacement income and healthcare benefits. The WSIB considered this a liability and the WSIB is no longer collecting premiums for the workers therefore it is an unfunded liability. The WSIB was advised that in the vent if they shut down and had to pay all their debts, they need that amount in a separate fund. This is known as the unfunded liability fund. This fund in Ontario is currently sitting at approximately $36 billion.

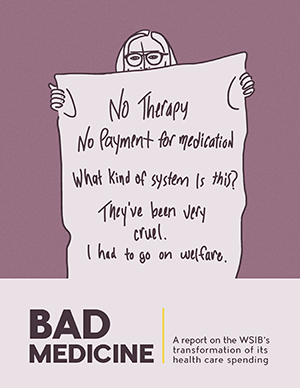

This report exposed one way the WSIB was able to reduce its expenses, by cutting healthcare costs, to build up the unfunded liability fund.

The report found that:

1. There has been a significant cut in prescription drug benefits that affects thousands of injured workers per year.

2. Health care spending has progressively shifted away from services whose sole focus is patient welfare, and towards services that are structured to drive down the cost of benefits paid to injured workers.

3. The primary measures the WSIB uses as evidence of improved health outcomes–the reduction in the incidence and severity of permanent impairments–are the result of changes to the WSIB’s adjudication practices. They constitute a cut in benefits themselves, rather than a reflection of improved health care.

|